Zerodha Demat Account Review 2023

Zerodha Demat Account Review 2023: Zerodha is an Indian financial services company that offers retail and institutional broking services, as well as other financial products such as mutual funds and bonds.

The company is known for its online trading platform, which allows users to invest in equities, derivatives, and currency.

Zerodha was founded in 2010 and is headquartered in Bengaluru, India. It is one of the largest retail stockbrokers in India in terms of active clients.

In this Post, we will discuss Zerodha Demat Account Review 2023 in Detail.

Also Read: Deciml App Referral Code: Daily Investing App

Zerodha offers a demat account, which is an account that holds securities such as shares and bonds in electronic form.

Zerodha’s demat account is known for its low fees, user-friendly interface, and wide range of features.

One of the main advantages of Zerodha’s demat account is its low fees.

Zerodha charges a flat annual maintenance charge (AMC) of Rs 300, which is lower than the industry average.

Zerodha also offers a lifetime AMC waiver for users who open a demat account with them.

Another advantage of Zerodha’s demat account is its user-friendly interface.

The account can be accessed through the company’s trading platform, Kite, which offers a clean and easy-to-use interface.

Users can view their account details and holdings, as well as place trades and track the performance of their investments, all from one place.

Zerodha’s demat account also offers a range of features to help users manage their investments.

These include an integrated mutual funds platform, an advanced portfolio tracker, and a feature called Kite Insight

Kite Insight provides users with market news, research reports, and other relevant information.

Additionally, Zerodha offers a free investment platform called Coin, which allows users to invest in mutual funds and direct equities without any transaction charges.

Overall, Zerodha’s demat account is a solid choice for retail investors looking for a user-friendly, low-cost demat account with a wide range of features.

However, it is always recommended to compare different options, check the fees and read the terms and conditions before opening a demat account.

Read More: Shoonya Referral Link, Offer & Code: Lifetime Zero Brokerage

About Zerodha

Zerodha is an Indian financial services company that was founded in 2010 by Nitin Kamath

The company is headquartered in Bengaluru, India

It offers retail and institutional broking services, as well as other financial products such as mutual funds and bonds.

Company is known for its online trading platform, which allows users to invest in equities, derivatives, and currency.

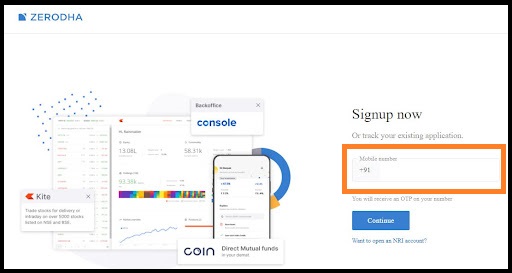

Zerodha Sign Up

To sign up for an account with Zerodha, you can follow these steps:

Go to the Zerodha website and click on the “Open an account” button.

Fill out the online form with your personal and contact information.

Upload the required documents, such as a government-issued ID and proof of address.

Complete the e-KYC (Know Your Customer) verification process.

Wait for your account to be approved and activated by Zerodha.

Once your account is active, you can log in to the trading platform and start trading.

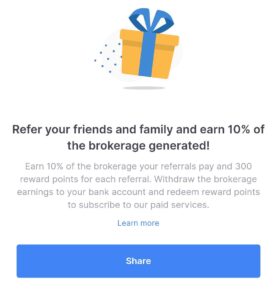

Zerodha Refer and Earn

It has a referral program that allows existing customers to refer new customers to the platform and earn rewards.

The referral program is called the “Zerodha Referral Program” or the “Partner Program”.

By referring friends and family to Zerodha, existing customers can earn referral bonus as a token of appreciation.

Here is how the referral program works:

- Existing customers can refer new customers to Zerodha by sharing their unique referral link or referral code.

- When a new customer signs up for an account with Zerodha using the referral link or code, they are considered a referred client.

- Once the referred client starts trading on Zerodha, the referrer will receive a referral bonus, which is typically a percentage of the trading fees generated by the referred client.

- The referral bonus is credited to the referrer’s Zerodha account and can be used to pay for trading fees or withdrawn as cash.

Read More: [A3YeExKx] Teji Mandi Referral Code : Invest in a Ready-Made Portfolio

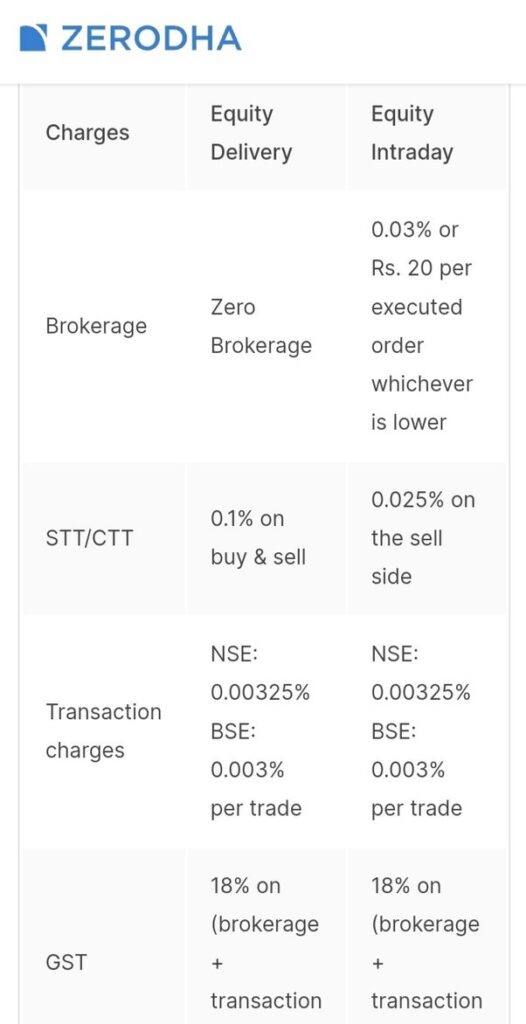

Zerodha Brokerage Charges

Here are some of the main charges that Zerodha may apply:

- Trading Fees: Zerodha charges a flat fee of Rs 20 per trade for equity delivery trades and Rs 20 per executed order for equity intraday and F&O trades.

- Demat account maintenance charges: Zerodha charges a flat annual maintenance charge (AMC) of Rs 300 for its demat account. However, Zerodha also offers a lifetime AMC waiver for users who open a demat account with them.

- Call & Trade: Zerodha also charges a flat fee of Rs 20 per call and trade order, which is an order placed over the phone with the help of Zerodha’s trading desk.

- Additional fees: Zerodha may also charge additional fees for other services such as currency trading, which typically incurs a 0.03% fee.

Key Features in Zerodha

One of the key features of Zerodha’s trading platform is its user-friendly interface and easy navigation.

The platform also offers a wide range of tools and resources for traders, such as charting software, market data, and research reports.

Additionally, Zerodha offers a mobile trading app for users who want to trade on the go.

Zerodha is also known for its low brokerage fees, which are significantly lower than the industry average.

The company charges a flat fee of Rs 20 per trade for equity delivery trades

Rs 20 per executed order for equity intraday and F&O trades.

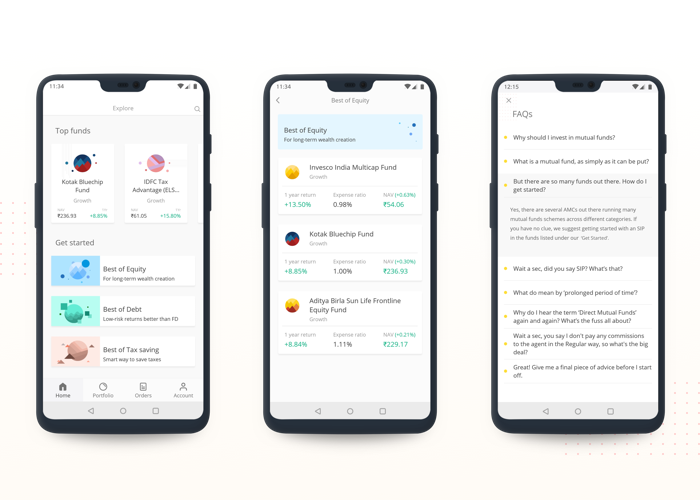

Zerodha also offers a brokerage-free equity investment platform called Coin

It allows users to invest in mutual funds and direct equities without any transaction charges.

In addition to its broking services, Zerodha also offers a range of other financial products and services.

The company has a mutual fund distribution platform called Zerodha MF Platform, which allows users to invest in mutual funds from leading fund houses.

Zerodha also offers a platform for fixed deposit and bond investments called Zerodha Fixed Income.

Read More: mStock App Review : Best For Regular Traders | Zero Brokerage Charges

Growth of Zerodha

Zerodha has grown rapidly since its launch in 2010 and is now one of the largest retail stockbrokers in India in terms of active clients.

As of 2021, the company had over 3.5 million active clients and a daily trading volume of over Rs 60,000 crore.

Zerodha has also won several awards for its services, including the “Best Retail Broker” award at the BSE-India International Financial Summit in 2016

It won “Best Digital Platform” award at the Moneycontrol Wealth Creator Awards in 2018.

In addition to its success in India, Zerodha has also expanded its reach to other countries, such as Dubai and Singapore.

The company has also launched a new platform called Zerodha Varsity, which is an online educational resource for traders and investors.

Zerodha Varsity provides a wide range of learning materials, including videos, articles, and quizzes

Kite App by Zerodha

Kite is a web and mobile-based trading platform offered by Zerodha, an Indian financial services company.

The platform is designed to provide a seamless and intuitive trading experience for users,

it includes with features such as advanced charting tools, real-time market data, and a wide range of order types.

Kite Connect

Kite offers a clean, user-friendly interface with customizable layouts, making it easy for users to navigate and find the information they need.

It has a feature called Kite Connect, which allows third-party developers to build their own trading and investing applications using Zerodha’s API.

This allows users to develop and customize their own trading strategies and tools.

The platform also includes real-time market data, including live quotes and charts,

It also provides a variety of technical indicators and drawing tools to help users analyze the markets.

Kite also supports a wide range of order types, including market, limit, stop loss, and bracket orders

Tools by Kite

In addition to its trading capabilities, Kite also offers a range of other features and tools to help users manage their investments.

These include an integrated mutual funds platform, an advanced portfolio tracker, and a feature called Kite Insight.

which provides users with market news, research reports, and other relevant information.

Kite is available as a mobile app for both iOS and Android devices, making it easy for users to trade on the go.

The app is regularly updated with new features and improvements, ensuring that users always have access to the latest tools and resources.

Overall, Kite is a powerful and user-friendly trading platform that offers a wide range of features and tools to help users manage their investments.

With its customizable layouts, advanced charting tools, and real-time market data, Kite is a great option for traders and investors of all levels.

Read More: Dhan App Referral Code : Invest in Stocks, Commodity, Options, Futures, Currency, ETF

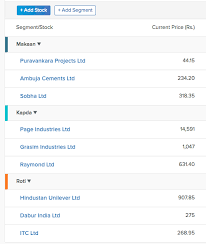

Smallcase is a platform for investing in pre-built, diversified portfolios of stocks and ETFs, called “smallcases”.

Smallcases can be bought and sold just like individual stocks, and the

Prices of the smallcases are determined by the underlying stocks and ETFs that they contain.

Users can invest in smallcases with as little as Rs. 1000 and can track their performance in real-time.

Smallcases are designed to make it easy for investors to gain exposure to a diversified portfolio of stocks and ETFs

Additionally, smallcases are regularly rebalanced to ensure that they continue to align with their investment themes and strategies.

Smallcases can be accessed via Zerodha’s trading platform, Kite, and can be traded through the same interface as individual stocks

This makes it easy for users to manage their investments.

It also come with detailed research and insights about the stocks and ETFs included in the smallcase,

It’s suitable for investors with a long-term investment horizon.

it is important to note that the performance of the smallcase may vary depending on the underlying stocks and ETFs, as well as the overall market conditions.

As with any investment, it is important to do your own research and understand the risks involved before investing.

Conclusion

That’s all about Zerodha Demat Account Review. If you liked this blog, share with your friends.

In conclusion, Zerodha is a leading Indian financial services company that offers a wide range of products and services for retail and institutional investors.

The company is known for its low brokerage fees, user-friendly trading platform, and wide range of financial products.

Zerodha’s platform, Kite, offers advanced charting tools, real-time market data, and a wide range of order types

Zerodha also offers a range of other financial products and services, including mutual funds, bonds, and fixed deposits.

Additionally, the company has a referral program, and a product called smallcases, which is a platform for investing in pre-built, diversified portfolios of stocks and ETFs.

Overall, Zerodha is a solid choice for retail investors looking for a user-friendly, low-cost platform with a wide range of features.

However, as with any financial services provider, it is always important to do your own research, compare different options,

1 thought on “Zerodha Demat Account Review 2023 | Brokerage Charges | Margin”