How to Earn Money from IPO, How Can I Earn Money from IPO: These are few terms which we are going to discuss in this post

IPO can be a great way to earn some money from share market.

It’s risk free kind of investment because you can only apply for those IPO which can give you high returns.

Suppose if you have applied for an IPO and You didn’t get the stocks on listing date then money will be refunded in your bank

Visit this website to get all updates related to IPO.

If shares are alloted, you book profit by selling it.

If shares are not alloted to you, money is safe in your bank account.

Also Read :

How to Earn Money From IPO

To earn money from an IPO, you can follow these steps:

Research the company

Before investing in an IPO, it’s important to research the company and its financials.

Look at the company’s financial statements, management team, competitors, and industry trends.

Look for underwriting banks and IPO date

IPOs are usually underwritten by investment banks, and the date of the IPO is announced well in advance.

Get an allocation

If you have an account with a brokerage firm, you can ask them if they’re able to get you an allocation of shares in the IPO.

Purchase shares on the IPO date

Once the shares are publicly traded, you can purchase them on the open market through a brokerage account.

Hold or sell shares

After the purchase, you can hold on to the shares in the hope that the stock price increases, or sell the shares.

If you believe the stock price will decrease.

It’s important to remember that the stock market is inherently risky.

There is no guarantee that a company’s stock will increase in value after an IPO.

It’s always a good idea to consult a financial advisor or to do your own research before taking any investment decisions.

What is IPO

An IPO is the process by which a privately-held company raises capital by selling shares of stock to the public.

The company issues shares of stock to the public in exchange for cash

Which it can then use to fund operations, expand its business, or pay off debt.

It’s important to remember that IPOs can be risky, especially when the company is not well-established

It has no track record as a publicly traded company.

It’s always a good idea to consult a financial advisor or to do your own research before taking any investment decisions.

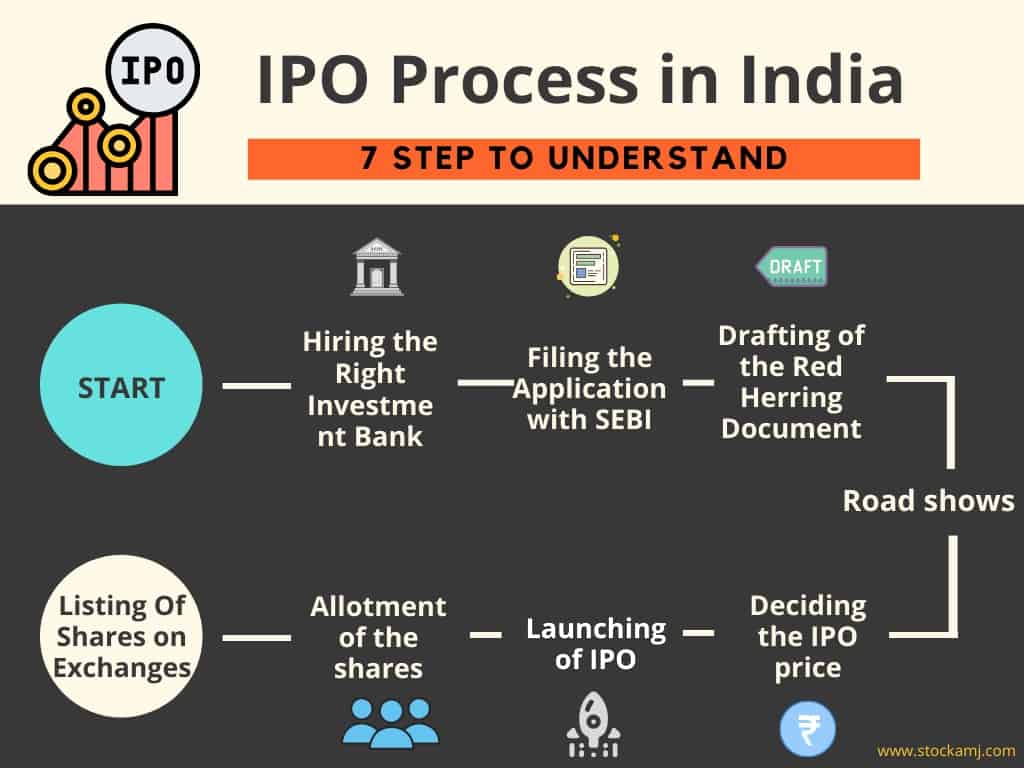

Process of IPO Filing

The IPO filing process in India involves several steps, including:

Appointing a merchant banker

The company must appoint a merchant banker to act as the lead manager for the IPO.

Filing the Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI)

The company must file the DRHP with SEBI, along with other required documents, such as the audited financial statements.

Obtaining in-principal approval

After the DRHP filing, SEBI reviews the documents and provide in-principal approval for the IPO.

Filing the Prospectus

After obtaining in-principal approval, the company must file the final prospectus with SEBI.

Obtaining final approval

After the prospectus filing, SEBI reviews the documents and provide final approval for the IPO.

Pricing the issue

The company determines the price of the shares to be sold in the IPO.

Allotment of shares

The shares are allotted to investors based on the demand received during the IPO.

Listing

After the allotment of shares, the shares are listed on the stock exchange for trading.

This process can take several months to complete and may take longer depending on the complexity of the IPO and any issues that arise during the review process.

Read More:

Choosing the Correct IPO | Which IPO You Should Apply

Selecting an IPO in India involves evaluating several factors, including:

Company’s financials:

It is important to review the company’s financial statements

These include balance sheet, profit and loss statement, and cash flow statement, to understand the company’s financial health and growth potential.

Industry analysis

It is also important to research the industry in which the company operates, to understand the growth prospects and competition in the industry.

Management quality

The quality of the management team is an important factor to consider as they will be responsible for the company’s future growth.

Valuation

It is important to analyze the valuation of the company, such as the Price to Earnings (P/E) ratio, to understand if the shares are undervalued or overvalued.

Book building process

It is also important to understand the book building process, which is the process of determining the price of the shares in an IPO.

If the book building process is fully subscribed and the price is at the higher end of the price band

it could mean that the company’s shares are in high demand and could be a good investment.

Risk vs return

Lastly, it is important to evaluate the risk-return trade-off of the investment.

It’s important to note that even if a company has strong fundamentals, the stock’s price may not perform as well as expected after listing.

It is due to various factors such as market conditions or investor sentiment.

Therefore, it’s important to diversify your portfolio and not to invest more than you can afford to lose.

Important Terms/Words Related to IPO

Here are some important terms related to IPO:

Initial Public Offer (IPO)

The process by which a privately-held company raises capital by issuing shares to the public for the first time.

Underwriting

The process of guaranteeing the sale of a certain number of shares in an IPO by an investment bank or a group of investment banks

Lead Manager

The investment bank or group of investment banks that manage the IPO process.

It act as the intermediary between the company and the public investors.

Book Building

The process of determining the price of the shares in an IPO through the collection of bids from investors.

Red Herring Prospectus (RHP):

A preliminary prospectus that is filed with the regulator

It contains information about the company and the IPO

It does not include the final offer price or the number of shares to be issued.

Prospectus

A document that contains detailed information about the company and the IPO

It includes the final offer price and the number of shares to be issued.

Allotment

The process of distributing shares to investors who have subscribed to the IPO.

Listing

The process of making the shares available for trading on a stock exchange after the completion of the IPO.

Grey Market

A market where shares of a company are traded before the shares are listed on a stock exchange

It is also known as unofficial market.

Over-subscription

A situation where the demand for shares in an IPO exceeds the number of shares offered.

Anchor Investors

Institutional investors who are allotted shares at a discount to the issue price

They are committed to hold the shares for a certain period of time.