CreditMantri Referral Code Earn: CreditMantri aims to reinvent the credit landscape by giving consumers access to responsible and transparent credit options.

You will get ₹100 paytm cash on every 3 successfull referrals who sign up using your invite link and enter their PAN card number during signup.

Paytm Cash will be sent within 7-10 working days on your paytm account. Start referring your friends on creditmantri website before refer and earn offer is expire.

Also Read: Teji Mandi Referral Code: Invest in a Ready-Made Portfolio

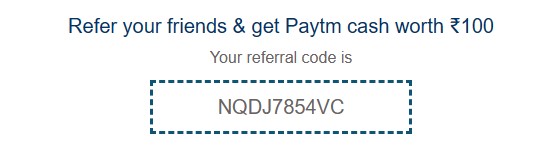

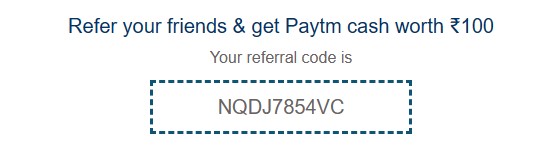

CreditMantri Referral Code Earn

| Website Name |

CreditMantri |

| CreditMantri Referral Code |

NQDJ7854VC |

| CreditMantri referral bonus |

₹100 Paytm Cash on Every 3 Successful Referrals |

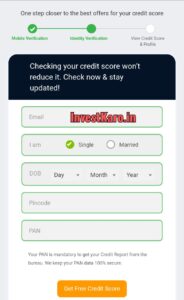

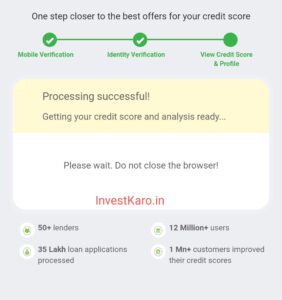

CreditMantri Check Free Credit Score -Sign Up

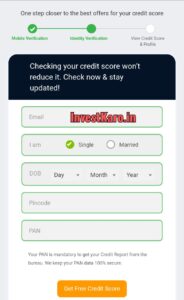

- Visit the CreditMantri website and navigate to the “Free Credit Score” tab.

Visit CreditMantri Website

- Enter your mobile number to get the OTP to authenticate.

- Enter CreditMantri Referral Code and earn Rs. 100 Paytm Cash.

- You will receive an OTP. Enter it.

- Enter details like your PAN number and date of birth.

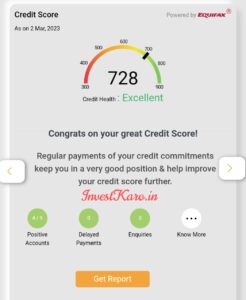

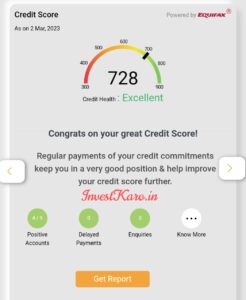

- You will get your credit score for free.

- Along, with the credit score, you can also check a free credit health analysis.

What is a Credit Score?

Features of CreditMantri

– Online Credit History and Score analysis with multi bureau format support

– Online problem resolution platform for clearing dues and issues on problem loan accounts

– Leveraging alternate data sources to build on user’s credit profile

– Real-time rule engine which matches with lender credit criteria and borrower credit profile

How is the credit score calculated?

Each credit bureau has its own formula to calculate the credit score.

Common man finds it baffling to understand the calculation of that 3-digit number that determines their creditworthiness.

The parameters used to calculate the score are very simple.

However, you might find variances in the credit scores from different bureaus as they allocate different value to each parameter.

Following are the key parameters that determine your credit score.

- Payment history – On-time and consistent repayment provide a positive score.

- Credit Utilization Ratio– Having low credit usage on your credit card provides a much-needed boost.

- Credit history – The longer the credit history, the higher the credit score.

- Credit mix– Having a mix of secured and unsecured credit is proof to the lender that you are able to handle the credit efficiently.

- Hard enquiry – Taking out credits within a short time negatively affects your credit score as there are too many hard enquiries involved.