mStock App Referral Code: In this another useful post, we will be discussing mStock App Review and specially about its brokerage and pricing model. M Stock is backed by Mirae Asset, an integrated financial services company.

If you are searching an answer about mStock App Review, You are at right Place. We will help you about mStock App Review in detail.

Mirae Asset is a South Korean company operating since 1997 and operating in India since 2006. (Don’t worry it’s legal, M-Shares is the product of an established company with a long history).

| Name Of Stock Broker | m.Stock |

| m.Stock Referral Link | Visit website |

| Brokerage Charges | Zero on Rs. 999 Plan |

Secondly, the zero brokerage plan is beneficial for those who trade regularly. On most platforms, you will be charged a flat fee of 20 rupees per order when selling shares.

Calculate Your Brokerage Savings

If you are a frequent trader with many trades every day, then Rs 999 for lifetime Brokerage Fee Waiver is justified.

To see how much you can save, flip through our Brokerage Fee Calculator, Enter the type of order, brokerage fee per order, and number. Use the number of orders (daily) to find out how much you can save.

In addition, all other government and SEBI-imposed fees continue to apply.

Zero brokerage fee is a way to get people to open his Demat account with M shares, but you have to pay STT/CTT, transaction fees, GST, SEBI fees, stamps and other fees.

Special Features of mStock App(Review)

- Free Intraday

- Free delivery

- Free F&O trades

- Free Mutual Funds

- Free IPOs

- Free Currency trades

- Free eMargin Facility

- No limit to number of orders

- No prior brokerage commitment

- No subscription attached

- No date of expiry

- No platform fee

- Also, Free Call & trade facility

Services Offered by mStock App(Review):

Below mentioned services are provided by mStock

IPO

Easy steps to apply online for an IPO:

- Open your account with m.Stock

- Select the IPO you want to invest in

- Add funds through UPI As easy as that!!

Stocks

You can identify shares of companies that have a great business plan to invest in & experience long term gains and exponential increase in your savings.

Equity investments offer unmatched liquidity and can easily be purchased and sold whenever you need.

| Charges | Equity Delivery | Equity intraday | Futures | Options |

|---|---|---|---|---|

| Brokerage | Zero | Zero | Zero | Zero |

| Call & Trade Charges | Zero | Zero | Zero | Zero |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.01% on sell side | 0.05% on sell side (on premium) |

| Transaction charges | NSE: 0.00345% BSE: 0.00345% |

NSE: 0.00345% BSE: 0.00345% |

NSE: 0.002% | NSE: 0.053% (on premium) |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI charges | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

Currency

Currency is one of the largest & highly liquid markets worldwide. That combined with a low margin requirement, makes it one of the best investments to include in your portfolio.

The four major currency pairs you can trade in are USD-INR, GBP-INR, EUR-INR, and JPY-INR.

| Charges | Futures | Options |

|---|---|---|

| Brokerage | Zero | Zero |

| Call & Trade Charges | Zero | Zero |

| STT/CTT | No STT | No STT |

| Transaction charges | NSE: Exchange txn charge: 0.0009% | NSE: Exchange txn charge: 0.035% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI charges | ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.0001% or ₹10 / crore on buy side | 0.0001% or ₹10 / crore on buy side |

Futures & Options

You can place trades with just 1 click for F&O Contracts and enjoy greater leverage, market efficiency, and the advantages of hedging, through F&O.

Futures & Options can be a great tool for diversification as well.

- Instant trade calculations

You can use advanced calculators that show real time profit / loss. This facilitates quick decision making.

-

Tools that assist your trade

- Simplified Trading

m.Stock is designed to ensure navigation with ease, along with in-app video & audio assistance. This helps even the most inexperienced trader, conduct trades smoothly.

- Seamless tracking

Have no hassle of storing transaction statements. m.Stock stores & processes all reports like Margin statements, Monthly settlement ledger, DP ledger etc – digitally at one place.

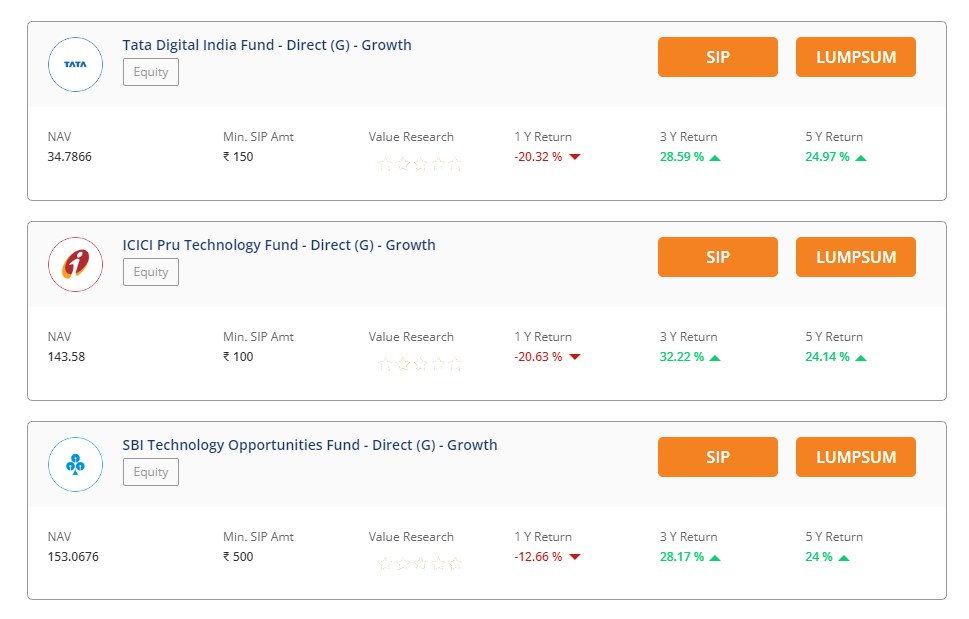

Mutual Funds

Adopting a Systematic Investment Plan, also known as an SIP, is one of the best ways to invest in the stock market. In an SIP, you make consistent monthly investments in an asset class of your choice over a period, thereby inculcating financial discipline. That’s not all. Thanks to rupee cost averaging, an SIP protects you from market downsides to a certain extent, and helps you create wealth over the long term.

Margin Trading Facility (eMargin)

| Charges | MTF (eMargin) |

|---|---|

| Interest Rate | 7.99% – 9.49% |

| Brokerage | Zero |

| Subscription Fee | Zero |

| Margin Pledge | ₹12 |

| GST | 18% on (brokerage + transaction charges) |

mStock App Referral Code | Refer and Earn

You get instant cashback of ₹333 on every successful referral. You can refer 3 friends and get 100% cashback of ₹999 on your

- Get instant cashback of ₹333 for every successful referral

- Open an m.Stock account in less than 5 minutes

-

Refer friends to m.Stock

-

Your friends open an m.Stock Zero Brokerage account

- You get ₹333 instant cashback for each successful referral and your friends get ₹149 as instant account opening fee cashback too!

-

To qualify for Refer & Earn rewards, you should be a customer of m.Stock and the Referee needs to open a ₹999 Zero Brokerage m.Stock account using your referral link.

Social Media Information of m.Stock App(Review) :

Facebook: Click

Instagram: Click

Twitter: Click

Youtube: Click

LinkedIn: Click