Mobikwik Xtra Review, Mobikwik Xtra Refer and Earn, Mobikwik Xtra Referral Code

MobiKwik has launched this investment product in partnership with Transactree Technologies Pvt Ltd, one of the largest and oldest P2P licensed NBFCs in India.

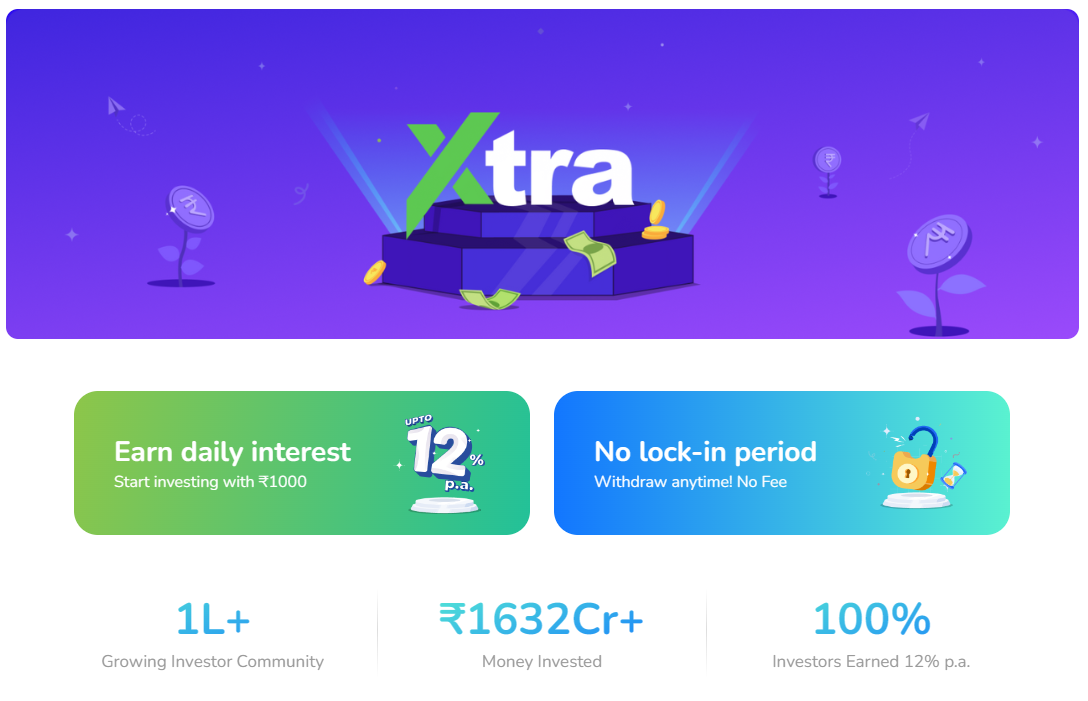

Xtra is an investment option that offers you the opportunity to earn up to 12% p.a. by lending directly to creditworthy borrowers.

This is done via an RBI-regulated peer-to-peer investing platform, Lendbox (Transactree Technologies Pvt Ltd).

Read More: Fyers App Referral Link Code | Your Gateway to Investing!

Any Indian above 18 years (resident or non-resident) or company with an active PAN Card and Indian bank account can invest with Lendbox. NRIs can also invest in Xtra via their NRO bank account.

What is P2P Lending?

Peer to Peer(P2P) Lending is a technology platform that allows participants to lend and borrow money, cutting out the traditional bank in between.

With technology intervention and smart algorithms, P2P lending companies are able to give small-ticket loans for shorter tenure to high-creditworthiness borrowers.

Investments of as small as Rs 1000 can be distributed to more than 100 borrowers with the use of technology hence diversifying risk.

The interest income earned from borrowers are distributed back to investors.

Also Read: Invest in a Ready-Made Portfolio

What makes MobiKwik Xtra (Review)a great investment?

-

Supervision & Regulation

Transactree Technologies Pvt Ltd is governed by RBI and regularly audited. In addition, MobiKwik also supervises these investments.

-

Proven Track Record

Combined experience of 10+ years in digital lending.

-

Stable and High returns

Daily interest has been credited to investors and 100% of them have received 12% returns so far.

-

Fully automated investment experience

Zero manual intervention both in investments and while making withdrawals. Free to transact at your convenience.

Have a look: Trade W App Review | Trade Forex, Cryptocurrency and More

How to get started with Mobikwik Xtra (Review)

Download MobiKwik App

Complete the KYC registration process.

Click on Xtra

Start your investment journey and earn daily interest.

Frequently Asked Questions

Who can invest in MobiKwik Xtra? Can NRIs invest?

Any Indian above 18 years (resident or non-resident) or company with an active PAN Card and Indian bank account can invest with Lendbox. NRIs can also invest in Xtra via their NRO bank account.

Is there a fee for investing in MobiKwik Xtra (Review)?

No, Xtra does not charge any investment fee or commission for deposits.

What are the risks with P2P investments?

As with any lending initiative, there are some risks- the biggest one being that a borrower doesn’t repay.

We along with lendbox ensure that we keep the risk to a minimum, by ensuring that every borrower your money is lent to is identity checked, credit-checked, and risk-assessed on numerous parameters.

Your investment is also diversified across multiple borrowers to minimize risk as much as possible, and all of the borrowers have to sign the legally binding loan agreement.

In case of a default, we use legally-compliant collections agencies to follow-up and collect missed payments on your behalf.

If a borrower ends up defaulting even after the recovery process is initiated, Lendbox and MobiKwik will earn no income till you get your indicated returns back.

Do reach out to us after you’ve read the terms & conditions and have questions before you make your first investment.

Are the 12% p.a. returns assured?

While there is no guarantee of 12% per annum, Lendbox risk analysis has proven that this number is probable as the risk of default from creditworthy borrowers of Lendbox is very low.

We closely work with our partner in assessing their risk models periodically and ensure low risk for investors.

How safe is the invested money?

Your money is routed directly through the escrow (3rd party) bank account which is managed by an independent trustee and money can be used only to lend to the borrowers.

Which documents do I need to start investing in MobiKwik Xtra (Review)

If you have already completed KYC with MobiKwik, no extra documentation is required. If not, you only need to perform PAN and Aadhar-based KYC to begin investing with Xtra.

Why does Xtra require my bank account details?

The details you provide are used to verify your account.

This is important as this account is where your invested amount along with the interest earned will be credited.

Also, your details are required to ensure that the name on your bank account matches with the provided KYC details as you can only make investments in your own name.

What are the investment options available in Xtra?

- Flexi investment offers interest upto 12% p.a. and no lock-in. User can withdraw anytime without any withdrawal fee

- Plus is a fixed tenure investment option offering interest upto 12.99% p.a. The lock-in tenures available for the investments are 3,6,9,and 12 months presently. Premature withdrawal may lead to loss of interest in this mode of investment.

When does my investment start generating returns?

After the payment is successful, it takes upto 48 hours for the interest to reflect in your portfolio.

Will my earnings be compounded?

Interest earned on your investments is not reinvested.

Earnings are added on a daily basis to your account and are available to withdraw based on the investment plan.

Are my earnings taxable? Will tax be deducted when I withdraw my earnings?

Interest income earned is taxable as per your income’s tax slab and is classified under ‘Other income’.

Tax will not be deducted at source, i.e., we will not deduct tax when you withdraw your money.

Do I get a tax certificate for my investments via Xtra?

Transactree Technologies Pvt Ltd (Lendbox) shall issue an interest certificate declaring the interest earned by user during each financial year, and this will be available on Xtra dashboard for the user to download.

Paying the applicable tax on income earned is the user’s responsibility and MobiKwik or Lendbox is not liable for any default on the same.

I am getting an error while adding my bank account.

You see an error because online verification of the bank account holder’s name has failed against your KYC documents available in the system.

Please share a copy of your self-attested bank account statement or canceled cheque leaf with the name of the account holder printed on it along with your KYC documents to xtra@mobikwik.com for our team to verify and update your bank account details.

How much can I invest?

You can start your investment with a minimum of Rs. 1,000 and go upto Rs. 10 lacs.

If you want to increase your investment beyond Rs. 10 lacs, you can request for Account Upgrade from the app.

As per RBI guidelines, for anyone investing above Rs. 10 lacs, a net worth certificate will be required. Post verification of the net worth certificate, the maximum investment limit can be Rs. 50 lacs

What payment methods are accepted on MobiKwik Xtra (Review)

You can make payment via UPI, Netbanking or transfer funds to your dedicated virtual account number via IMPS/NEFT/RTGS.

Via IMPS/NEFT/RTGS your investments go by default into Xtra Flexi for now.

Via UPI you can transact for upto Rs. 1 Lac. Payment via credit card is not allowed by RBI for P2P investments.

Money has been debited from my bank account but Xtra says the payment is unsuccessful.

Any amount debited from your bank account in such a scenario will be automatically refunded back into the source account within 3-7 working days.

I’m unable to add funds via netbanking.

This could happen if the amount you are trying to invest is more than the third party transaction (TPT) limit set by your bank account or you have not registered for TPT facility with your bank.

In both cases, you can connect with your bank to resolve this.

I’m unable to add funds via UPI.

This could happen if you have exhausted your daily UPI transaction limit, which is Rs. 1 Lac for most banks and lower for some others.

How can I transfer funds using IMPS/NEFT/ RTGS?

For every user there is a unique system generated Virtual Bank Account.

You can add this account as a beneficiary in your default bank account and make IMPS/NEFT/RTGS based transfers. Any deposit into this Virtual Bank Account will be mapped for Flexi investment plan.

Once the transfer is completed, you need to share the transaction reference number/ UTR of the successful bank account transfer for the investment to reflect in your portfolio.

Please be very careful while adding the account number and sharing the transaction details/UTR as any inaccuracy will lead to failure of automatic mapping of the amount to your Xtra account and will need to be manually resolved after you share the correct details.

This manual mapping effort may take up to 7-10 business days and will lead to loss of interest for you.

I’ve transferred funds via IMPS/RTGS/NEFT but my portfolio is not updated.

It takes up to 30 minutes for the partner to update the portfolio once the correct transaction details/UTR are shared by you.

If your amount is still not updated in the portfolio, please reach out to us at xtra@mobikwik.com with your transaction reference number and proof of transaction from your bank account.

Successful transaction screenshot or a debit transaction from your bank statement is treated as a proof of transaction for our team to help resolve your issue.

Will I have to pay any fees for withdrawing my funds ?

No fees or charges are applicable for withdrawal from Flexi mode of investment.

Will I have to pay any fees for withdrawing my funds ?

No fees or charges are applicable for withdrawal from Flexi mode of investment.

What happens on maturity to my investments in Xtra Plus?

On maturity, by default, the amount (principal + interest) earned in Xtra Plus gets re-invested in the same tenure plan.

If you wish to withdraw funds from Xtra Plus on maturity, please change the “On maturity” preference to “Transfer to Flexi” from the Ongoing investment section on Xtra dashboard.

Once the funds are transferred to Flexi, you can withdraw them to your bank account anytime without any fees.

How long will it take for my withdrawal to reach my bank account?

The time taken to process the withdrawal and receive funds in your bank account depends on when the request has been submitted.

If the withdrawal request is submitted on a working day before 4 PM, then the amount will be processed by the end of the same working day.

However, if the withdrawal request is submitted after 4 PM on a working day or on a non-working day, then the amount will be processed on the next working day.

Please note that all withdrawals are processed on a best effort basis once your loans are sold to the next investor in line.

Can I withdraw multiple times from my Xtra account?

No, you can only make one withdrawal request at a time. Till a previous withdrawal request is processed, a new withdrawal request cannot be placed for Xtra Flexi investments.

Who can request for an account upgrade?

Any user with invested amount equal to or above Rs. 8 Lacs will be provided an option to upgrade their account. To unlock higher investment limits, users are required to furnish a proof of NetWorth of Rs. 50 Lacs.

Who can request for an account upgrade? (MobiKwik Xtra Review)

Any user with invested amount equal to or above Rs. 8 Lacs will be provided an option to upgrade their account. To unlock higher investment limits, users are required to furnish a proof of NetWorth of Rs. 50 Lacs.

What is the process of account upgrade?

You can apply for account upgrade by submitting asset documents that show a minimum net worth of Rs. 50 Lacs.

Documents such as bank statements, investment portfolios, NSDL statements, etc that show assets clearly belonging to you are treated as an asset document.

Once your documents are received, they will be reviewed by a practicing Chartered Accountant.

The CA after verifying and approving the documents generates an official net worth certificate, post which your investment limit is increased to Rs. 50 Lacs.

If the documents are not approved, you will be able to see the updated status of your account upgrade request as rejected and option to upload a more recent, clear and valid document.

How safe are my documents?

Your documents will only be used to review your net worth and upgrade your account.

During this process, they will be encrypted with limited access to the reviewers, in short, your documents will be completely safe and will not be used for any other purpose.

What happens when my portfolio value exceeds Rs. 10Lacs?

In case your portfolio value exceeds Rs. 10Lacs, the extra amount will move into the “Undeployed Funds” section on the app.

This amount will not generate you interest and can be withdrawn to your bank account.

Alternatively, you can upgrade your investment limits to Rs. 50 Lacs and invest the additional funds to start generating interest.

What happens if I transfer funds above my investable limit via IMPS/NEFT/RTGS into Xtra Flexi?

In case your portfolio value exceeds Rs. 10Lacs with the additional transaction, the entire amount of the transaction will move into the “Undeployed Funds” section on the app.

This amount will not generate any interest and can be withdrawn to your bank account only.

Alternatively, you can upgrade your investment limits to Rs. 50 Lacs and invest the additional funds to start generating interest.

2 thoughts on “Mobikwik Xtra Review | Should you Invest for 12% Return?”