IQ Option India Review: What You Need to Know in 2025

IQ Option India Review: IQ Option is a global online trading platform founded in 2013, offering a wide range of financial instruments including binary options, forex, stocks, ETFs, and cryptocurrencies.

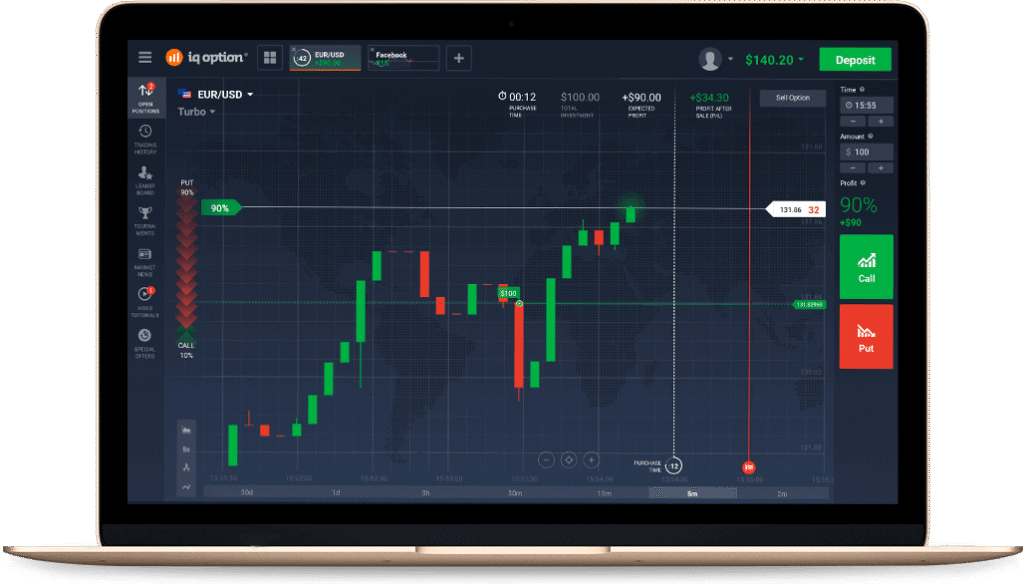

It has gained massive popularity due to its intuitive interface, educational content, and low entry barrier.

Also Read: Tradingo App Review | Benefits, Pricing, Margins & Charges

With over 100 million registered users across 130+ countries, IQ Option is licensed by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) of Seychelles.

It caters to both beginners and experienced traders through its demo accounts, analytical tools, and multi-device accessibility.

Is IQ Option Legal in India?

Legality around platforms like IQ Option in India is a gray area.

IQ Option is not banned in India, nor is it directly regulated by Indian authorities like SEBI or RBI.

It operates under international regulation and allows Indian users to trade at their discretion.

Important Notes for Indian Users:

- Always ensure compliance with FEMA (Foreign Exchange Management Act).

- Use international payment gateways or wallets like Neteller, Skrill, or UPI via third-party apps.

- IQ Option may not offer INR as a base currency, so conversion charges apply.

Key Features of IQ Option

1. Wide Range of Instruments

- Binary options (1 min to 5 min trades)

- Digital options

- Forex currency pairs

- Stocks & ETFs

- Cryptocurrencies (BTC, ETH, XRP, etc.)

2. Blitz Trading

- 5-second expiry options, perfect for scalpers.

- Real-time charts and tools like MACD, RSI, Bollinger Bands.

3. Demo Account

- Comes with $10,000 virtual funds.

- No credit card required.

- Great for strategy testing.

4. Mobile App

- Over 100M+ downloads on Play Store.

- Average rating of 4.1 stars.

- Real-time trading, alerts, and withdrawal requests.

Deposit, Withdrawal & Fees

Deposit Options for Indian Users

- Minimum Deposit: ₹700 (approx. $10)

- Supported Methods: UPI (via third-party apps), Neteller, Skrill, Visa/Mastercard

- Processing Time: Instant or within 5 minutes

Withdrawal Process

- Minimum Withdrawal: $2

- Timeframe: 1 to 3 working days

- Charges: No platform fee, but external charges may apply

- Methods: Same as deposits

Tip: Complete KYC verification to speed up withdrawals.

Pros and Cons for Indian Traders

Pros:

- Low ₹10 deposit makes it beginner-friendly

- Demo account with real-time data

- Wide asset selection and risk-control tools

- 24/7 support and education center

Cons:

- Not regulated by Indian authorities

- No INR wallet support

- Price lags may occur during high-volatility events

How to Start with IQ Option in India

Step-by-Step Guide: IQ Option India Review

- Visit iqoption.com

- Click on “Sign Up” and enter basic details

- Choose demo or real account

- Verify email and complete KYC

- Add funds via Neteller/Skrill/UPI

- Start trading using mobile or desktop

IQ Option vs Olymp Trade

| Feature | IQ Option | Olymp Trade |

|---|---|---|

| Minimum Deposit | ₹700 (approx) | ₹350 |

| Demo Account | Yes ($10,000 virtual) | Yes |

| Regulation | CySEC, FSC | VFSC, FinaCom |

| Blitz Options | Yes (5 sec expiry) | No |

| Mobile App Rating | 4.1/5 | 4.2/5 |

| Withdraw Time | 1-3 days | 1-5 days |

FAQs: IQ Option India Review

Is IQ Option legal in India?

Yes, it is legal to use at your own risk. Not regulated by SEBI/RBI.

How much is the minimum deposit?

As low as ₹700 (~$10).

How long do withdrawals take?

Usually within 1-3 business days.

Can I use UPI or Indian cards?

Yes, via third-party wallets like Skrill or Neteller.

Is it beginner-friendly?

Absolutely. A demo account and tutorials make it great for starters.

Verdict: IQ Option India Review

If you are a beginner in India looking to explore online trading with a small budget, IQ Option offers one of the best platforms to start with.

It’s intuitive, supports multiple instruments, and provides a solid educational foundation.

However, since it’s not under Indian regulation, always trade responsibly and understand the legal boundaries.

Use the demo to master your strategy before risking real money.

What is IQ Option?

IQ Option is a global online trading platform founded in 2013, offering a wide range of financial instruments including binary options, forex, stocks, ETFs, and cryptocurrencies.

It has gained massive popularity due to its intuitive interface, educational content, and low entry barrier.

With over 100 million registered users across 130+ countries, IQ Option is licensed by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Services Commission (FSC) of Seychelles.

It caters to both beginners and experienced traders through its demo accounts, analytical tools, and multi-device accessibility.

Is IQ Option Legal in India?

Legality around platforms like IQ Option in India is a gray area. IQ Option is not banned in India, nor is it directly regulated by Indian authorities like SEBI or RBI.

It operates under international regulation and allows Indian users to trade at their discretion.

Important Notes for Indian Users:

- Always ensure compliance with FEMA (Foreign Exchange Management Act).

- Use international payment gateways or wallets like Neteller, Skrill, or UPI via third-party apps.

- IQ Option may not offer INR as a base currency, so conversion charges apply.

Key Features of IQ Option

1. Wide Range of Instruments

- Binary options (1 min to 5 min trades)

- Digital options

- Forex currency pairs

- Stocks & ETFs

- Cryptocurrencies (BTC, ETH, XRP, etc.)

2. Blitz Trading

- 5-second expiry options, perfect for scalpers.

- Real-time charts and tools like MACD, RSI, Bollinger Bands.

3. Demo Account

- Comes with $10,000 virtual funds.

- No credit card required.

- Great for strategy testing.

4. Mobile App

- Over 100M+ downloads on Play Store.

- Average rating of 4.1 stars.

- Real-time trading, alerts, and withdrawal requests.

Deposit, Withdrawal & Fees

Deposit Options for Indian Users

- Minimum Deposit: ₹700 (approx. $10)

- Supported Methods: UPI (via third-party apps), Neteller, Skrill, Visa/Mastercard

- Processing Time: Instant or within 5 minutes

Withdrawal Process

- Minimum Withdrawal: $2

- Timeframe: 1 to 3 working days

- Charges: No platform fee, but external charges may apply

- Methods: Same as deposits

Tip: Complete KYC verification to speed up withdrawals.

Pros and Cons for Indian Traders

Pros:

- Low ₹10 deposit makes it beginner-friendly

- Demo account with real-time data

- Wide asset selection and risk-control tools

- 24/7 support and education center

Cons:

- Not regulated by Indian authorities

- No INR wallet support

- Price lags may occur during high-volatility events

How to Start with IQ Option in India

Step-by-Step Guide:

- Visit iqoption.com

- Click on “Sign Up” and enter basic details

- Choose demo or real account

- Verify email and complete KYC

- Add funds via Neteller/Skrill/UPI

- Start trading using mobile or desktop

IQ Option vs Olymp Trade

| Feature | IQ Option | Olymp Trade |

| Minimum Deposit | ₹700 (approx) | ₹350 |

| Demo Account | Yes ($10,000 virtual) | Yes |

| Regulation | CySEC, FSC | VFSC, FinaCom |

| Blitz Options | Yes (5 sec expiry) | No |

| Mobile App Rating | 4.1/5 | 4.2/5 |

| Withdraw Time | 1-3 days | 1-5 days |

FAQs

Is IQ Option legal in India?

Yes, it is legal to use at your own risk. Not regulated by SEBI/RBI.

How much is the minimum deposit?

As low as ₹700 (~$10).

How long do withdrawals take?

Usually within 1-3 business days.

Can I use UPI or Indian cards?

Yes, via third-party wallets like Skrill or Neteller.

Is it beginner-friendly?

Absolutely. A demo account and tutorials make it great for starters.

Verdict: Is IQ Option Right for You?

If you are a beginner in India looking to explore online trading with a small budget, IQ Option offers one of the best platforms to start with.

It’s intuitive, supports multiple instruments, and provides a solid educational foundation.

However, since it’s not under Indian regulation, always trade responsibly and understand the legal boundaries. Use the demo to master your strategy before risking real money.